Federal Government Mileage Rate 2025 - Government Mileage Calculator IRS Mileage Rate 2025, What is the federal mileage reimbursement rate for 2025? The cra has issued the mileage rate for 2025, applicable from january 1 until december 31, 2025. The rate for medical or moving purposes in 2025 decreased to 21 cents.

Government Mileage Calculator IRS Mileage Rate 2025, What is the federal mileage reimbursement rate for 2025? The cra has issued the mileage rate for 2025, applicable from january 1 until december 31, 2025.

.png)

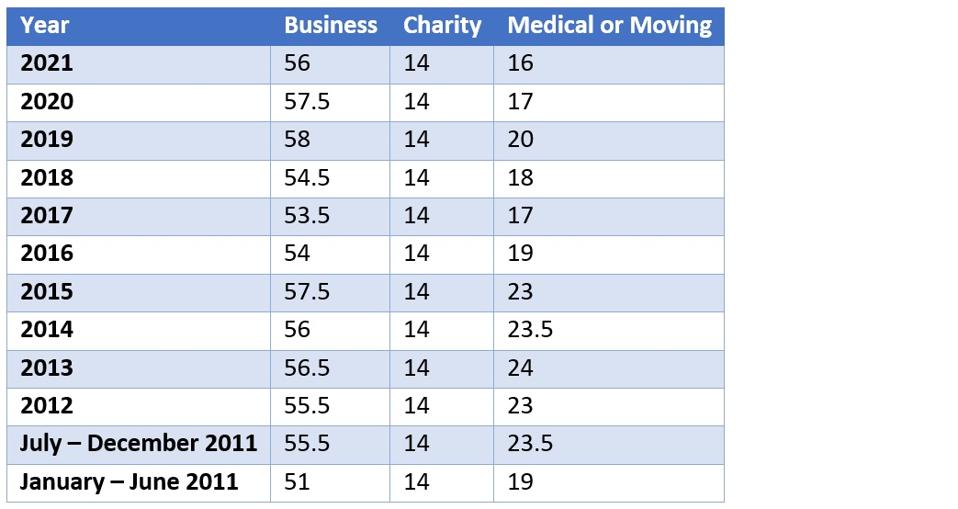

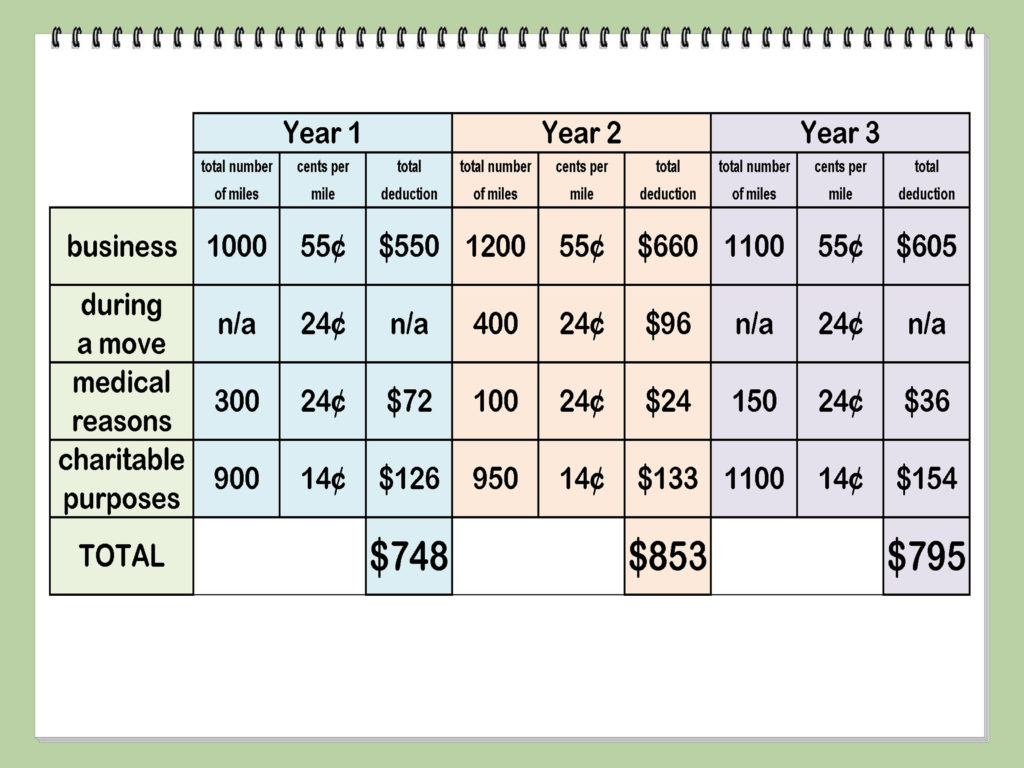

IRS Announces 2025 Mileage Rates, For 2023, the irs' standard mileage rates are $0.655 per mile for business, $0.22 per mile for medical or moving, and $0.14 per mile for charity. 64¢ per kilometre driven after that.

2025 Standard Mileage Rates Released by IRS; Mileage Rate Up, The standard mileage rates for 2023 are: The rates payable in cents per kilometre for the use of privately owned vehicles driven on authorized government business travel are shown.

2023 standard mileage rates released by IRS, The new rate kicks in beginning jan. Cy 2025 standard mileage rate for moving purposes.

Standard Mileage Rate 2025 Ambur Marianna, March 26, 2025 — united states attorney jacqueline c. The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year.

67 cents per mile, up 1.5 cents from 65.5 cents in 2023.

The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. 64 cents per kilometre after that.

Federal Government Mileage Rate 2025. The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. What is the federal mileage reimbursement rate for 2025?

Batman The Brave And The Bold 2025. January 24, 2025 cover price:. Aquaman faces down […]

On december 14, 2023, the internal revenue service (irs) issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile.

IRS Mileage Rates 2025 What Drivers Need to Know, The automobile allowance rates for 2025 are: If you are an employer, go to automobile and motor.